Generate insightful financial reports in FreshBooks by customizing templates and using detailed analytics. Regularly review reports to identify growth opportunities.

Financial reporting is crucial for business growth. FreshBooks offers customizable templates that help create detailed and insightful financial reports. These reports provide valuable insights into your business’s financial health. By regularly reviewing these reports, you can identify trends, monitor cash flow, and uncover opportunities for growth.

FreshBooks’ user-friendly interface makes it easy to generate these reports, ensuring you stay informed and make data-driven decisions. Start leveraging FreshBooks today to drive your business forward and achieve financial success.

Financial Reporting In Freshbooks

FreshBooks is a powerful tool for managing your business’s finances. It helps you generate insightful financial reports. These reports are crucial for understanding your business’s health. With FreshBooks, creating these reports is simple and efficient. Let’s dive into why these reports matter.

Importance Of Financial Reports

Financial reports provide a clear picture of your business’s finances. They show your income, expenses, and overall financial status. These reports help you make informed decisions. They also help you track your financial progress over time.

- Income Statements: Show your revenue and expenses over a period.

- Balance Sheets: Present your assets, liabilities, and equity.

- Cash Flow Statements: Detail your cash inflows and outflows.

Role In Business Growth

Financial reports play a key role in business growth. They help you identify trends and patterns. You can spot areas where you are overspending. You can also see where you are making the most profit.

| Report Type | Benefit |

|---|---|

| Income Statement | Identifies profitable areas |

| Balance Sheet | Shows financial stability |

| Cash Flow Statement | Tracks liquidity |

Using these reports, you can set realistic goals. You can create strategies to achieve them. FreshBooks makes it easy to generate these reports. Thus, it drives your business growth.

Setting Up Freshbooks For Reporting

Setting up FreshBooks for reporting is crucial for insightful financial reports. Proper setup ensures accurate data, leading to better business decisions.

Account Configuration

Configuring your FreshBooks account is the first step in generating accurate reports.

- Set Up Your Business Profile: Include your business name, address, and contact information.

- Configure Tax Settings: Ensure tax rates and settings are correctly entered.

- Connect Bank Accounts: Sync your bank accounts for real-time financial data.

These steps ensure your reports reflect true financial health.

Customizing Settings

Customizing FreshBooks settings tailors reports to your business needs.

- Create Custom Categories: Organize expenses and income into relevant categories.

- Set Up Recurring Invoices: Automate invoicing for regular clients.

- Adjust Report Settings: Choose specific data points for detailed insights.

These customizations provide deeper insights into your finances.

| Setting | Purpose |

|---|---|

| Business Profile | Identifies your business in reports. |

| Tax Settings | Ensures tax compliance in reports. |

| Bank Connections | Provides real-time financial data. |

| Custom Categories | Organizes financial data for clarity. |

| Recurring Invoices | Streamlines billing processes. |

| Report Settings | Customizes data points in reports. |

Key Financial Reports In Freshbooks

FreshBooks offers several vital financial reports. These reports help businesses grow. They provide insights into financial health and performance. Let’s explore the key financial reports available in FreshBooks.

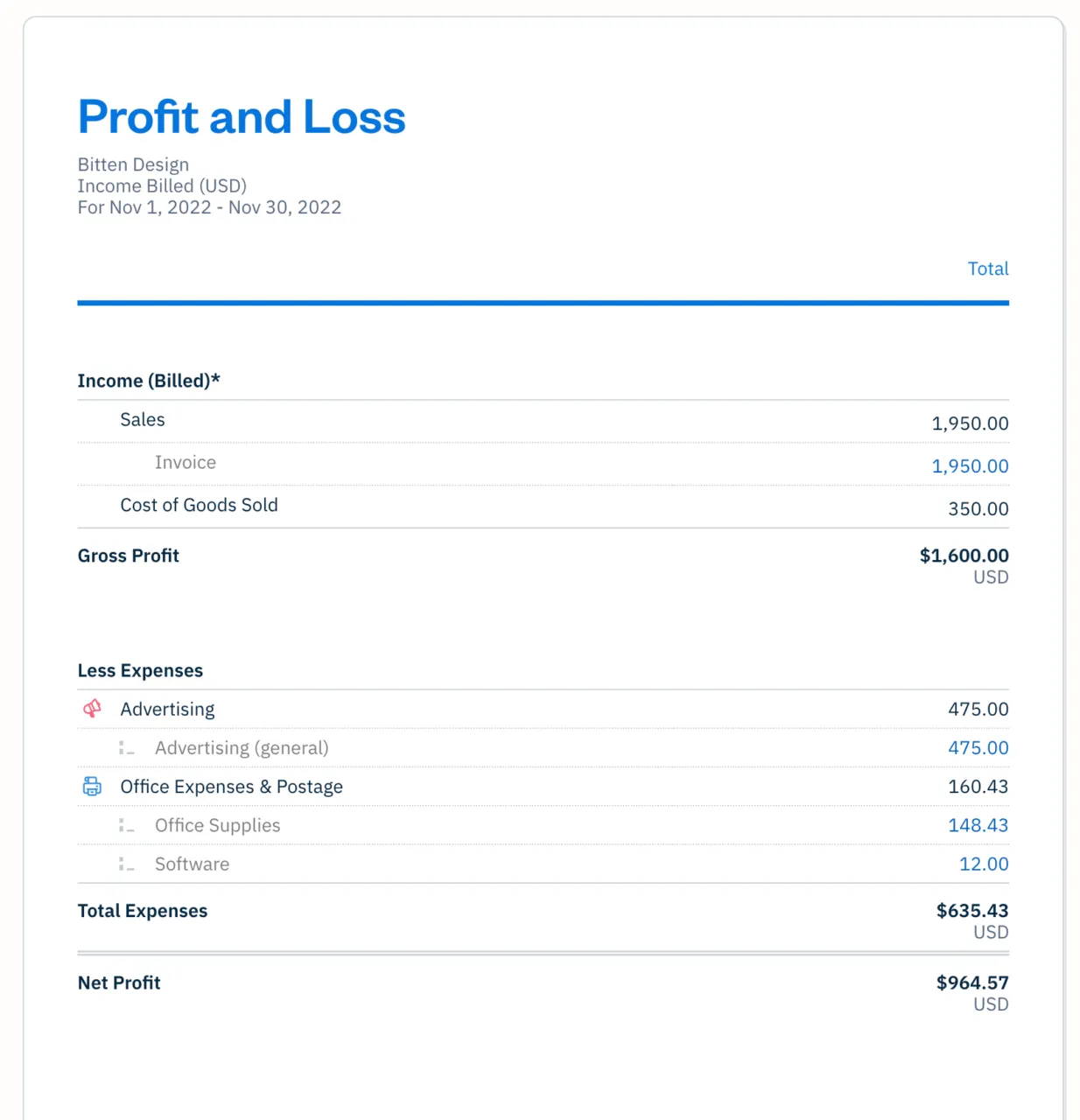

Profit And Loss Statement

The Profit and Loss Statement shows your revenue and expenses. It helps you understand your net profit or loss. This report is essential for tracking your financial performance over time.

You can analyze:

- Total revenue

- Operating expenses

- Net profit or loss

Generate this report to see if your business is making money or losing it.

Balance Sheet

The Balance Sheet provides a snapshot of your financial position. It lists your assets, liabilities, and equity. This report is crucial for understanding what your business owns and owes.

| Assets | Liabilities | Equity |

|---|---|---|

| Cash, Inventory, Property | Loans, Accounts Payable | Owner’s Equity |

Review your balance sheet to assess your financial health.

Cash Flow Report

The Cash Flow Report tracks the movement of cash in and out of your business. It helps you manage liquidity and plan for the future. This report ensures you have enough cash to cover your expenses.

- Operating Activities: Cash from sales and expenses

- Investing Activities: Cash from asset purchases or sales

- Financing Activities: Cash from loans or investments

Use this report to keep track of your cash flow and make better decisions.

Generating Accurate Reports

Accurate financial reports are crucial for business growth. They provide insights into your financial health. FreshBooks offers tools to generate these reports easily. But, you need to follow some best practices.

Data Entry Best Practices

Correct data entry is vital. Follow these best practices:

- Consistency: Always use the same format for dates and amounts.

- Double-Check Entries: Verify data before saving it.

- Use Categories: Assign expenses and income to categories.

- Update Regularly: Enter data promptly to avoid errors.

These steps ensure your data is accurate. Accurate data leads to reliable reports.

Avoiding Common Errors

Many businesses make common errors. Here are some to avoid:

- Incorrect Categorization: Mislabeling expenses skews your reports.

- Duplicate Entries: Entering the same transaction twice causes confusion.

- Ignoring Small Expenses: Small costs add up and affect your totals.

- Not Reconciling Accounts: Always match your records with bank statements.

By avoiding these errors, your reports will be more accurate. Accurate reports help in making better business decisions.

Interpreting Financial Data

Understanding financial data is crucial for business growth. This involves analyzing trends and identifying key metrics. FreshBooks provides tools to help with this. Let’s dive into these aspects to make your financial reports insightful.

Analyzing Trends

Analyzing trends helps you understand your business’s performance over time. FreshBooks allows you to track revenue, expenses, and profits. Look at monthly or quarterly trends.

- Revenue growth: Compare revenue over different periods.

- Expense patterns: Identify consistent and fluctuating expenses.

- Profit margins: Analyze changes in profit margins over time.

Use graphs and charts in FreshBooks to visualize trends. This makes it easier to spot patterns and make informed decisions. Consistently review these trends to stay ahead.

Identifying Key Metrics

Key metrics provide insights into your business health. FreshBooks offers several important metrics to watch.

| Metric | Description |

|---|---|

| Net Profit | Total revenue minus total expenses. |

| Cash Flow | Money moving in and out of your business. |

| Accounts Receivable | Money owed to you by clients. |

| Accounts Payable | Money you owe to vendors. |

Monitor these metrics to understand your financial position. This helps you make strategic decisions for growth. FreshBooks makes it easy to access and understand these metrics.

Using Reports To Drive Growth

Using insightful reports in FreshBooks can drive business growth. Financial reports provide critical data to help make informed decisions. They highlight trends, opportunities, and areas for improvement. This section explores how to use reports effectively for strategic planning and performance monitoring.

Strategic Planning

Strategic planning involves setting long-term goals for your business. FreshBooks reports provide valuable insights to shape your strategy. Use profit and loss statements to understand your revenue streams. Identify which products or services generate the most income. This data helps allocate resources efficiently.

Cash flow statements reveal how money moves through your business. Positive cash flow ensures you have funds for growth initiatives. FreshBooks makes it easy to track this with detailed reports. Balance sheets show the financial health of your business. They list assets, liabilities, and equity.

Use this data to make informed decisions about investments. Here’s a quick overview:

| Report | Purpose |

|---|---|

| Profit & Loss Statement | Identify revenue streams and cost management |

| Cash Flow Statement | Monitor cash movement and financial stability |

| Balance Sheet | Evaluate overall financial health |

Performance Monitoring

Performance monitoring helps track progress towards your goals. FreshBooks offers various reports for this. Use the expense report to monitor spending patterns. Identify areas where costs can be reduced. This will improve your profit margins.

Time tracking reports are useful if you bill clients by the hour. They show how much time is spent on different projects. This helps in optimizing your team’s productivity. Invoice reports help track outstanding payments. Ensure you follow up on unpaid invoices to maintain cash flow.

Here are some key reports for performance monitoring:

- Expense Report: Track and analyze spending patterns.

- Time Tracking Report: Monitor time spent on projects.

- Invoice Report: Keep track of unpaid invoices.

Using these reports helps in making data-driven decisions. This ensures your business stays on the path to growth.

Advanced Reporting Features

Advanced reporting features in FreshBooks can help you generate insightful financial reports. These features provide valuable data that can drive business growth. FreshBooks offers various tools to customize reports and integrate with other software. This section will explore how to leverage these advanced reporting features.

Custom Reports

FreshBooks allows you to create custom reports tailored to your needs. You can filter data based on different criteria such as date range, client, or project. This helps you get specific insights into your financial performance.

Custom reports can include tables, charts, and graphs. These visual elements make complex data easy to understand. You can also save and export these reports in various formats like PDF or Excel.

| Feature | Description |

|---|---|

| Filter Options | Filter by date range, client, or project |

| Visual Elements | Include tables, charts, and graphs |

| Export Formats | Save as PDF, Excel, and more |

Integrations And Add-ons

FreshBooks integrates with many popular tools and add-ons. These integrations help you streamline your reporting process. You can connect FreshBooks with your CRM, payroll, and tax software.

Integrations allow for automatic data sync, reducing manual entry and errors. Popular integrations include QuickBooks, PayPal, and Gusto. Using these integrations can save you time and improve accuracy.

- QuickBooks

- PayPal

- Gusto

These add-ons can enhance your reporting capabilities. They offer additional features that are not available in FreshBooks alone.

Tips For Continuous Improvement

Generating insightful financial reports in Freshbooks can drive business growth. Implementing continuous improvement practices ensures your reports stay relevant and effective. Here are some tips for continuous improvement.

Regular Review

Regularly reviewing your financial reports helps identify trends and patterns. Set a schedule to review reports weekly or monthly. Use these reviews to spot opportunities and challenges early. This proactive approach can boost business growth.

Consider using a checklist for your review process:

- Check for accuracy and completeness of data.

- Analyze income and expenses.

- Compare actual performance to forecasts.

- Identify areas for cost reduction.

Seeking Professional Advice

Seeking professional advice can greatly enhance your financial reporting. Accountants and financial advisors offer expert insights. They can help you interpret complex data and make informed decisions.

Here’s how you can benefit from professional advice:

- Gain a deeper understanding of financial metrics.

- Receive tailored advice for your business type.

- Ensure compliance with financial regulations.

- Develop strategies for long-term growth.

By following these tips, you can continuously improve your financial reports in Freshbooks. This will ultimately drive your business growth.

Frequently Asked Questions

What Is The Importance Of Financial Reports In Freshbooks?

Financial reports in FreshBooks provide insights into your business’s financial health. They help identify trends, track expenses, and monitor revenue. These reports aid in making informed decisions, ensuring business growth.

How Do I Generate A Profit And Loss Report?

To generate a profit and loss report in FreshBooks, navigate to the “Reports” section. Select “Profit & Loss” and customize the date range. Click “Generate Report” to view your financial performance over time.

Can I Customize Financial Reports In Freshbooks?

Yes, you can customize financial reports in FreshBooks. Select the report you want to customize and adjust the date range, categories, and filters to suit your needs.

How Often Should I Review Financial Reports?

Review financial reports regularly, at least monthly. Regular reviews help you stay on top of your financial health, identify trends, and make informed business decisions.

Conclusion

Generating insightful financial reports in FreshBooks is essential for driving business growth. Utilize its features to analyze key metrics. Make informed decisions based on accurate data. Consistent reporting will help you identify trends and opportunities. Implement these strategies to enhance your financial management and support long-term business success.