Discover the best accounting software for small businesses in 2025! Streamline invoicing and track finances with top picks like QuickBooks, the #1 accounting software for small businesses.

Managing finances is one of the most critical aspects of running a small business. Whether you’re tracking expenses, creating invoices, or preparing for tax season, accounting software can make your life much easier. As someone who has used various accounting tools over the years, I’ve seen firsthand how the right software can save time, reduce stress, and help you stay on top of your business finances. In this article, I’ll share my experiences with some of the best accounting software for small businesses in 2025. Let’s dive in!

Why Accounting Software is Essential for Small Businesses

Running a small business means wearing many hats. You’re not just the owner; you’re often the accountant, marketer, and operations manager all rolled into one. Accounting software helps simplify one of the most complex tasks—managing your finances. Here’s why it’s indispensable:

- Saves Time: Automates repetitive tasks like invoicing and expense tracking.

- Improves Accuracy: Reduces errors in calculations and ensures compliance with tax regulations.

- Provides Insights: Offers detailed reports on profit and loss, cash flow, and more.

- Scales with Your Business: As your business grows, the software can adapt to handle more complex needs.

When I first started my own small business, I used spreadsheets to manage everything. It didn’t take long to realize that this method was error-prone and time-consuming. Switching to accounting software was a game-changer—it allowed me to focus more on growing my business rather than crunching numbers.

Top Features to Look for in Accounting Software

Choosing the right accounting software depends on your specific needs. Here are some features that I’ve found incredibly useful:

- Invoicing: The ability to create and send professional invoices quickly.

- Expense Tracking: Automatically categorize and track expenses.

- Bank Integration: Sync with your bank accounts for real-time updates.

- Payroll Management: Handle employee payments seamlessly.

- Customizable Reports: Generate detailed financial reports tailored to your needs.

- Mobile Access: Manage your finances on the go with a mobile app.

When evaluating software, think about what features are must-haves for your business. For example, if you’re a service-based business, time tracking and project management might be crucial. If you deal with inventory, look for robust inventory management tools.

Best Accounting Software for Small Businesses in 2025

Here’s a detailed look at some of the top accounting tools available this year:

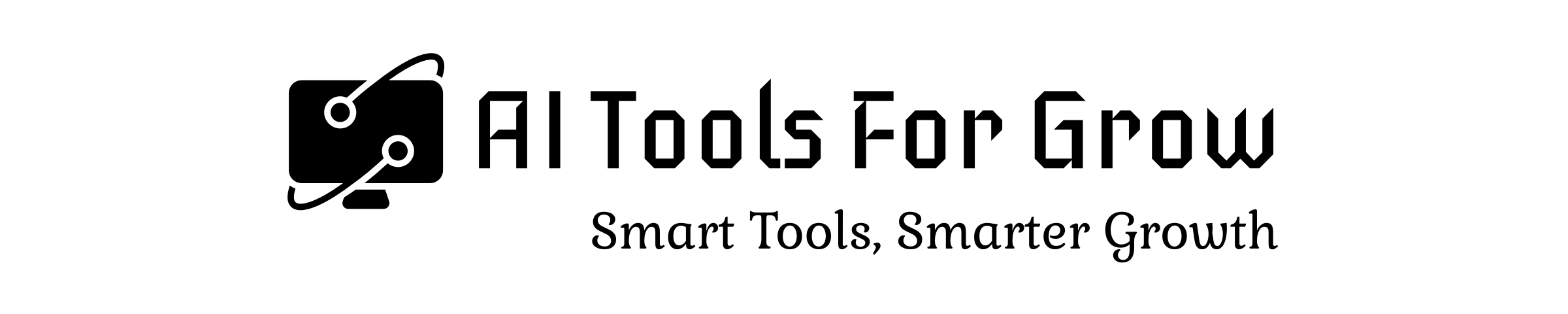

1. QuickBooks Online

QuickBooks Online has been my favorite software for years. It’s incredibly versatile and packed with features that cater to both beginners and experienced users. QuickBooks Online has been my go-to software for years. It’s incredibly versatile and packed with features that cater to both beginners and experienced users. The intuitive interface makes navigation a breeze, allowing even those with minimal accounting experience to manage their finances efficiently. From tracking expenses and creating invoices to handling payroll and generating detailed financial reports, QuickBooks Online covers all the bases.

One of my favorite aspects is its cloud-based nature, which means I can access my financial data from anywhere, at any time, and on any device. This flexibility is invaluable for managing my business on the go. Plus, the automatic backups and security measures provide peace of mind, knowing that my data is safe and secure.

The range of integrations available with other apps and services further enhances its functionality. Whether it’s syncing with my bank for real-time transaction updates or connecting with e-commerce platforms to streamline my sales data, QuickBooks Online seamlessly fits into my existing workflow.

The customer support and resources offered by Intuit are top-notch. Whenever I encounter an issue or need advice on utilizing a particular feature, the extensive help center and community forums are just a click away. For more personalized assistance, the live chat and phone support options have always been prompt and helpful.

Overall, QuickBooks Online continues to evolve, regularly rolling out updates and new features that keep it at the forefront of accounting software. Whether you’re a small business owner, freelancer, or part of a larger enterprise, it’s an investment that pays off in efficiency, accuracy, and peace of mind.

Key Features:

- Robust invoicing and expense tracking

- Bank reconciliation

- Payroll integration

- Customizable reports

Pros:

- Easy to use

- Scalable plans for growing businesses

- Excellent mobile app

Cons:

- Can be pricey for small budgets

QuickBooks Online is perfect if you want an all-in-one solution that grows with your business. The mobile app is particularly handy—I’ve used it to send invoices while traveling, which saved me a lot of time.

2. FreshBooks

FreshBooks is ideal for service-based businesses like freelancers or consultants. Its intuitive interface makes it easy to use even if you’re not tech-savvy. FreshBooks is ideal for service-based businesses like freelancers or consultants. Its intuitive interface makes it easy to use even if you’re not tech-savvy. The platform offers a range of features specifically designed to streamline administrative tasks, such as invoicing, expense tracking, and time management. Users can quickly create professional-looking invoices, automate payment reminders, and even accept credit card payments directly through the system.

FreshBooks provides robust reporting tools that give insights into your financial health, helping you make informed business decisions. The mobile app ensures you can manage your finances on the go, allowing you to track time, record expenses, and communicate with clients from anywhere. With its strong customer support and seamless integrations with other popular business tools, FreshBooks empowers service-based professionals to focus more on delivering quality work and less on paperwork.

Key Features:

- Time tracking

- Project management

- Online payment options

- Recurring invoices

Pros:

- User-friendly interface

- Great customer support

- Affordable plans

Cons:

- Limited inventory management

I’ve recommended FreshBooks to friends who run small service-based businesses, and they love its simplicity. It’s especially useful if you need to track billable hours.

3. Xero

Xero is another excellent choice, particularly if you need multi-user access or advanced inventory management. Xero is another excellent choice, particularly if you need multi-user access or advanced inventory management. It offers a range of features designed to streamline accounting processes for small to medium-sized businesses. Xero allows for real-time collaboration, enabling multiple users to access and work on the financial data simultaneously, which is ideal for businesses with teams working remotely or from different locations.

Its multi-user capabilities, Xero’s advanced inventory management tools help businesses keep track of stock levels, manage purchase orders, and analyze sales patterns. This can lead to more informed decision-making and improved operational efficiency. The platform also provides integration with various third-party apps, enhancing its functionality and allowing businesses to customize their accounting and inventory systems to suit their specific needs.

With Xero, users can benefit from automated bank feeds, invoicing, expense tracking, and financial reporting, all accessible through a user-friendly interface. The platform’s robust security measures ensure that sensitive financial data is protected, giving business owners peace of mind. Furthermore, Xero’s customer support and extensive online resources make it easy for users to get the help they need to maximize the platform’s potential.

Overall, Xero’s comprehensive features and flexibility make it a strong contender for businesses seeking a reliable accounting solution tailored to their evolving needs.

Key Features:

- Unlimited users

- Inventory tracking

- Bank reconciliation

- Payroll integration

Pros:

- Affordable plans

- Strong reporting tools

- Integrates with many third-party apps

Cons:

- Learning curve for beginners

I used Xero when managing a team because it allowed multiple users to access financial data simultaneously. This feature was a lifesaver during tax season when my accountant needed real-time data.

4. Wave

If you’re on a tight budget, Wave offers free accounting software that covers basic needs. If you’re on a tight budget, Wave offers free accounting software that covers basic needs. It provides features like income and expense tracking, invoicing, and receipt scanning, making it a suitable option for freelancers, small business owners, and entrepreneurs who require essential financial management tools without the associated costs.

While the software is free, Wave also offers optional paid services, such as payroll and payment processing, which can be integrated seamlessly if your business needs expand. Additionally, the user-friendly interface and cloud-based accessibility ensure that you can manage your finances efficiently from anywhere, at any time.

Key Features:

- Free invoicing and expense tracking

- Receipt scanning

- Basic financial reports

Pros:

- Completely free for basic features

- Simple setup process

Cons:

- Limited advanced features

- No payroll outside the U.S.

Wave was my first accounting tool when I started out because it was free and easy to use. While it lacks some advanced features, it’s perfect for startups or side hustles.

5. Zoho Books

Zoho Books is part of the larger Zoho ecosystem, making it an excellent choice if you already use other Zoho products. Zoho Books is part of the larger Zoho ecosystem, making it an excellent choice if you already use other Zoho products. This integration allows for seamless data sharing and streamlined workflows across different applications, such as Zoho CRM, Zoho Projects, and Zoho Inventory.

With Zoho Books, users can efficiently manage their finances, automate business workflows, and gain insights into their financial health. The platform offers features like invoicing, expense tracking, bank reconciliation, and financial reporting, which help businesses maintain accurate records and make informed decisions.

Zoho Books supports various integrations and customization options, enabling businesses to tailor the software to their specific needs. Its user-friendly interface and comprehensive support make it accessible for businesses of all sizes, from small startups to large enterprises.

Key Features:

- Seamless integration with Zoho CRM and other apps

- Project management tools

- Multi-currency support

Pros:

- Affordable pricing

- Comprehensive feature set

Cons:

- Can be too complex for very small businesses

I tried Zoho Books when experimenting with their CRM system, and the integration was seamless. It’s a great option if you’re looking for an interconnected suite of business tools.

How to Choose the Right Accounting Software

Selecting the best accounting software depends on several factors:

- Business Size and Type

- Freelancers might prefer FreshBooks or Wave.

- Retail businesses may benefit from Xero’s inventory features.

- Budget

- Consider both upfront costs and ongoing subscription fees.

- Ease of Use

- If you’re not tech-savvy, opt for user-friendly platforms like FreshBooks or Wave.

- Scalability

- Choose software that can grow with your business needs.

- Integration Options

- Ensure it integrates with other tools you use, like CRM or payroll systems.

When I chose QuickBooks Online, I considered its ability to handle both my current needs and future growth as my business expanded.

FAQs

1. Do I need accounting software if I have an accountant?

Yes! Accounting software complements your accountant by automating daily tasks like invoicing and expense tracking. It also provides real-time data that your accountant can use for strategic planning.

2. Is free accounting software reliable?

Free options like Wave are reliable but limited in features. They’re great for startups or very small businesses but may not suffice as your business grows.

3. Can I switch accounting software later?

Yes, but migrating data can be tricky. Choose software that allows easy export/import functions to simplify transitions.

4. Do these tools work offline?

Most modern accounting tools are cloud-based, meaning they require an internet connection. Some offer limited offline functionality through mobile apps.

5. How secure is cloud-based accounting software?

Reputable providers like QuickBooks Online and Xero use encryption and other security measures to protect your data.

Final Thoughts

Accounting software is more than just a tool—it’s an investment in your business’s success. Whether you’re just starting out or looking to upgrade from spreadsheets, there’s an option out there that fits your needs and budget perfectly.From my personal experience, QuickBooks Online stands out as the most versatile option for small businesses due to its comprehensive feature set and scalability.

However, if you’re looking for simplicity or affordability, FreshBooks or Wave might be better suited for you.

Take advantage of free trials offered by most providers to test them out before committing. Trust me—once you find the right fit, managing your finances will feel less like a chore and more like an opportunity to grow your business!