Is your accounting department struggling with inefficient processes and time-consuming tasks? It’s time to consider implementing AI tools in your financial processes. In this blog, we will discuss how AI is being used in accounting, the benefits of using AI tools, and how to choose the right tool for your business. We have also compiled a list of the top 10 AI tools for accounting and finance, along with their key features and how they work. We will also cover common challenges that businesses face while implementing these tools and provide solutions to overcome them. Finally, we will explore the future of AI in accounting and how it can revolutionize the way we handle financial tasks. By the end of this blog, you will have a better understanding of how AI tools can streamline your financial processes and help you achieve greater efficiency in your business operations.

How is AI Being Used for Accounting?

AI is revolutionizing the accounting industry by automating tasks and utilizing advanced analytics. This technology streamlines repetitive processes, allowing accountants to focus on strategic work. With improved accuracy and reduced human error, AI-powered tools analyze vast amounts of financial data for actionable insights, empowering decision-making.

The Benefits of Implementing AI Tools in Accounting Processes

Implementing AI tools in accounting processes offers numerous benefits. These tools streamline financial tasks, boosting efficiency and accuracy. By reducing human error, they provide more reliable financial data. Additionally, AI tools automate reporting and analysis, saving time and providing real-time insights for informed decision-making. They also improve reconciliation processes, ensuring up-to-date and accurate financial information. With machine learning capabilities, these tools help with forecasting and decision-making based on historical financial data.

Improved Efficiency in Financial Processes

AI tools in accounting are game-changers, automating time-consuming tasks like data entry and categorization. This reduces manual work, speeds up financial transactions, and improves efficiency. Real-time insights provided by AI tools enhance financial reporting, enabling faster business decisions. Cloud-based AI tools allow for remote access to financial data and collaboration among team members. Streamlining the invoice processing and approval process, AI tools save time and effort. These tools are a valuable asset for businesses looking to streamline their financial processes.

Reduction of Human Error in Accounting Tasks

AI tools in accounting are a game-changer when it comes to reducing human error in bookkeeping and other financial tasks. Through automation and AI algorithms, these tools minimize manual data entry, decreasing the potential for mistakes and discrepancies in financial data. Additionally, AI tools provide real-time data insights, allowing for early identification and resolution of errors. With automated reconciliation and auditing features, accuracy in financial statements is ensured. The use of AI tools in accounting can significantly improve the reliability and integrity of financial processes.

Automated Reporting and Analysis

Automated reporting and analysis is a game-changer in the accounting industry. With the help of AI tools, businesses can generate accurate and relevant financial reports automatically. Real-time analytics provided by these tools enable effective tracking of financial performance. Customizable templates make it easier to present and analyze data. Furthermore, AI technology allows for the automated extraction and analysis of financial data from multiple sources. These tools also provide actionable workflows for more informed decision-making.

How to Choose the Right AI Tool for Your Business

When choosing an AI tool for your business, it is important to consider your specific needs and pain points in your accounting processes. Additionally, evaluate the scalability and integration capabilities of the AI tool with your existing systems. It is also crucial to assess the user-friendliness of the AI tool and its alignment with your team’s skillset. Analyzing the cost-benefit ratio and seeking recommendations from other businesses in your industry will help you make an informed decision.

Identify Your Specific Needs and Pain Points

To identify your specific needs and pain points in the accounting process, start by evaluating which financial processes require improvement. Look for specific pain points such as manual invoicing, expense tracking, or financial reporting. Research accounting AI tools that can automate these tasks, ensuring they integrate with your existing systems. Consider the cost-benefit analysis of implementing an AI tool, and select a tool that offers customer support and training to maximize its potential.

Consider the Scalability and Integration of the Tool

When choosing an AI tool for accounting, it’s important to consider its scalability and integration capabilities. Look for a tool that can handle your current needs but also has the ability to scale as your business grows. Additionally, ensure that the AI tool can integrate smoothly with your existing accounting software and other tools. Testing the tool’s accuracy with sample data before implementation is crucial. Consider how the tool can automate repetitive tasks and reduce the time and cost needed for manual processes. Lastly, choose a tool that provides sufficient training and support for successful implementation and use.

Evaluate the User-Friendliness and Cost of the Tool

When selecting accounting AI tools, it’s crucial to consider user-friendliness and cost. Look for tools with intuitive interfaces for easy navigation. Balancing the tool’s cost with potential savings from increased efficiency is important. Evaluate the tool’s integration capabilities with existing financial systems, ensuring seamless data exchange. Features like automated data entry, intelligent categorization, and real-time reporting can enhance productivity. Additionally, consider the level of customer support provided by the tool’s vendor to ensure a smooth experience.

Top 10 AI Tools for Accounting and Finance

When it comes to streamlining financial processes and improving efficiency in the accounting and finance industry, there are a variety of AI tools available. Some top contenders in this field include VIC.AI, an AI-powered platform for automating invoice processing and expense management. INDY is another AI technology that streamlines financial data entry and categorization. Botkeeper offers AI-driven bookkeeping and accounting software with automation capabilities. Sage Intacct is a cloud-based ERP system that leverages AI for financial insights, while Xero provides accounting software with AI features for efficient financial management. Lastly, Docyt is an AI-powered platform that offers real-time insights into financial health and performance. These AI tools are game-changers in the industry, helping businesses automate their financial processes and make accurate and informed decisions.

VIC.AI

Automate invoice processing and AR reconciliation using AI technology, leveraging machine learning algorithms for accurate categorization and data entry. Gain real-time insights into cash flow and financial performance, streamlining the approval process with automated workflows. Improve tax compliance with AI-powered tools. VIC.AI is a game-changer in the financial services industry, offering a powerful app that simplifies payroll and enhances efficiency. Its advanced AI capabilities, combined with Google integration and VAT pricing, make it a top choice for businesses looking to streamline their accounting processes.

INDY

Automate the data entry and categorization of financial transactions with INDY, an AI-powered accounting tool. By leveraging natural language processing, INDY enables efficient invoice processing, streamlining expense management processes. Access real-time financial reports and analytics for enhanced decision-making. INDY reduces human error and saves time on manual accounting tasks, making it a game-changer in the world of financial services. Say goodbye to tedious memorization and let INDY handle your accounting needs seamlessly.

Botkeeper

Automate your bookkeeping and accounting tasks with Botkeeper, a game-changing AI tool. Using advanced artificial intelligence and machine learning algorithms, Botkeeper accurately categorizes your data for seamless financial management. Gain access to real-time insights and reporting, empowering you to make informed decisions. Streamline your accounts payable processes through automation, reducing manual work and improving efficiency. Say goodbye to tedious tasks and let Botkeeper handle your financial tasks with ease.

Sage Intacct

Sage Intacct is a game-changer in the world of accounting AI tools. With its AI-powered analytics, businesses can gain real-time financial insights, enabling better decision-making. The automation capabilities of Sage Intacct streamline financial processes and workflows, improving efficiency while reducing human error. Customizable reports and dashboards provide users with interactive visualizations for quick analysis. Additionally, Sage Intacct leverages AI technology to identify discrepancies and enhance data entry accuracy. By incorporating Sage Intacct into your financial services, you can streamline your accounting processes and improve overall accuracy.

Xero

Automate your accounting processes with the help of Xero, an AI-powered tool that streamlines financial tasks. Gain access to real-time financial data for informed decision-making and simplify tax compliance through automation capabilities. With Xero, you can streamline invoice processing and payment reconciliation, improving cash flow management. This game-changer in accounting integrates AI-driven insights to ensure efficient financial services. Experience the benefits of artificial intelligence with Xero.

Docyt

Docyt is an AI-powered tool that offers real-time insights into your financial health. With its automation capabilities, you can streamline invoice processing and data entry, reducing manual work in accounting processes. It also provides customizable financial reports and analytics to help you make informed decisions. By leveraging AI technology, Docyt improves efficiency and simplifies expense management. Say goodbye to tedious tasks and embrace the game-changing benefits of artificial intelligence in your financial processes.

Booke AI

Booke AI is a game-changer in the accounting industry. With its artificial intelligence capabilities, it offers real-time insights for better financial decision-making. This app automates time-consuming accounting tasks, saving businesses valuable time and resources. Booke AI uses machine learning algorithms to efficiently reconcile financial data and helps with forecasting and cash flow management. Additionally, it streamlines invoice processing and categorization, improving overall efficiency in financial processes.

Truewind

Truewind is a game-changer in the world of accounting. This cloud-based AI tool simplifies expense management, automates the accounts payable process, and provides real-time analytics for better financial decision-making. With Truewind, you can generate customized financial reports and gain actionable insights. It streamlines your financial processes, saving time and reducing human error. Truewind is the app you need to streamline your accounting tasks and improve financial transparency.

ZENI.AI

ZENI.AI is an AI-powered platform that leverages natural language processing to simplify invoice processing and automate financial transactions. This game-changing tool helps businesses comply with tax regulations, stay organized, and reduce manual work. With ZENI.AI, you can streamline your accounting process and gain access to accurate and real-time financial data for informed decision-making. Say goodbye to tedious tasks and hello to a more efficient and error-free financial management system.

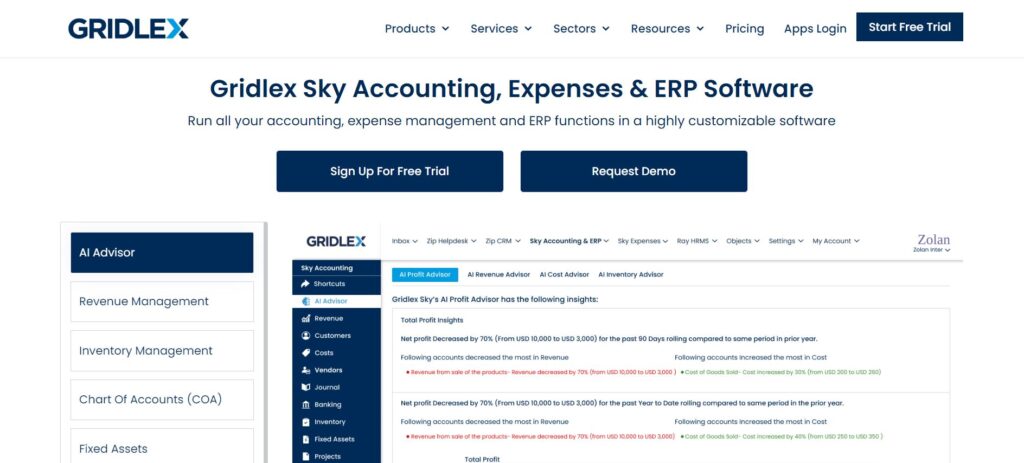

Gridlex Sky

Gridlex Sky is an AI-powered accounting automation platform that streamlines financial processes. With Gridlex Sky, businesses can automate the approval process, resulting in faster and more efficient workflows. This AI tool seamlessly integrates with popular accounting software like QuickBooks and Xero, making it a game-changer for financial services. By using Gridlex Sky, businesses can identify discrepancies, improve financial accuracy, save time on data entry, and focus on strategic tasks.

Blue Dot

Blue Dot is an AI-based financial intelligence platform that provides real-time insights into your business’s financial health. With this AI tool, you can make informed decisions using accurate data. Blue Dot automates financial reconciliation, reducing errors and streamlining your accounting processes to improve efficiency. By utilizing Blue Dot, businesses can enhance their financial operations and gain a competitive edge in the market.

Bill & Divvy

Bill & Divvy is an AI-powered expense management solution that automates expense tracking and simplifies reimbursement processes. With predictive analytics, this game-changing AI tool provides better budgeting and cost control. Integration with popular accounting software ensures seamless workflows, eliminating the need for manual receipt tracking and saving time. Experience the benefits of Bill & Divvy by streamlining your financial processes with this innovative app.

How These Tools Work and Their Key Features

AI accounting tools are game-changers in the financial services industry, automating repetitive tasks like data entry and categorization. These tools leverage artificial intelligence and machine learning algorithms to streamline accounting processes. Integration with other software, such as invoicing and payment processing systems, further enhances their functionality. By using AI accounting tools, businesses can benefit from increased accuracy, efficiency, and cost savings. However, it is essential to consider security and data privacy measures when choosing the right tool for your business.

Automated Data Entry and Classification

Automating data entry and classification is a game-changer for accounting processes. With the help of AI tools, businesses can save time and reduce errors by automating mundane tasks such as data entry. These tools also accurately classify transactions, making it easier to track expenses and revenues. Moreover, AI tools can identify anomalies and unusual transactions that may require further investigation, helping to prevent fraud. By leveraging AI in accounting, financial reports can be generated quickly, providing valuable insights into a business’s financial performance. This allows accountants to focus on more strategic tasks that require human expertise.

Predictive Analytics for Forecasting and Budgeting

AI-powered predictive analytics have become a game-changer in the field of accounting. These tools analyze historical data using artificial intelligence algorithms, helping businesses forecast financial trends and create accurate budgets. By identifying patterns and making predictions about future performance, predictive analytics aid in cash flow planning and risk management. Integration with other accounting software allows for streamlined financial processes and real-time insights. This saves time and reduces errors compared to manual methods, making predictive analytics an invaluable tool in the world of accounting.

Customizable Reporting and Dashboards

Customizable reporting and dashboards are a game-changer in the world of accounting AI tools. These tools automate tedious tasks like data entry and reconciliation, allowing for more efficient financial processes. By tracking key financial metrics, they provide valuable insights through the identification of patterns and anomalies. Additionally, AI-powered forecasting aids in budget planning and decision-making. Integration with other software and platforms further streamlines overall financial processes. With these tools, financial reporting becomes customizable and effortlessly streamlined.

Common Challenges and Solutions in Implementing Accounting AI Tools

Implementing accounting AI tools can present common challenges related to data accuracy and compatibility. To address these issues, businesses can implement robust data validation processes and ensure compatibility between systems. These tools are game-changers for financial processes, automating tasks like data entry and analysis to streamline operations. By reducing errors and improving efficiency, AI tools also offer cost savings. When selecting an accounting AI tool, factors such as ease of implementation and integration with existing systems should be considered.

The Future of AI in Accounting

The future of AI in accounting is brimming with potential for automation. As artificial intelligence advances, it will enhance the accuracy and efficiency of financial processes. With advanced AI algorithms, companies can expect more sophisticated analysis and forecasting capabilities. Moreover, AI-powered chatbots have the potential to handle customer inquiries and provide support in accounting. Additionally, the integration of AI and blockchain technology will bolster security and transparency in financial transactions.

Conclusion

In conclusion, implementing AI tools in accounting processes can significantly streamline financial workflows and improve overall efficiency. By leveraging automation and machine learning capabilities, these tools help reduce human error, automate reporting and analysis, and enhance decision-making processes. When choosing the right AI tool for your business, it’s essential to identify your specific needs and pain points, consider scalability and integration, and evaluate user-friendliness and cost. Some top AI tools for accounting and finance include VIC.AI, INDY, Botkeeper, Sage Intacct, Xero, Docyt, Booke AI, Truewind, ZENI.AI, Gridlex Sky, Blue Dot, and Bill & Divvy. These tools offer features such as automated data entry and classification, predictive analytics, and customizable reporting. While implementing accounting AI tools may come with challenges, the future of AI in accounting looks promising, with continued advancements and innovations in this field.

Pingback: Top 15 AI Advertising Tools for Success - AI Tools For Grow